Foreign Investment

drives

Canada's steady

growth

In 2023, Canada once again generated a year-over-year increase in foreign direct investment (FDI), solidifying Canada’s position as a premier destination for global investment. The year saw record-high numbers of sustainable projects, advancing Canada’s green transition while drawing on Canadian clean energy expertise. Investors chose Canada in 2023 for many reasons: rich natural resources, clean energy grid, abundance of skilled talent, innovation ecosystem, global market access and strategic location.

Canada continues to build on its strengths to attract large, transformative FDI projects that are stimulating economic growth, creating jobs and benefiting communities across the country. The Invest in Canada FDI Report 2023 shares the year’s FDI facts, figures, insights and key projects.

This report uses numbers and analysis based on reported data from Statistics Canada, FDI activity data, and announcements compiled by fDi Markets and PitchBook. Unless otherwise noted, all data is presented in Canadian dollars. For more information, see our methodology.

2023 In review

$62.3 billion in total FDI

13.9% higher than the 10-year average

Source: Statistics Canada, Table 36-10-0473-01

Retrieved: June 3, 2024

660 projects announced +

29K jobs forecasted

Source: fDi Markets, PitchBook

Retrieved: June 3, 2024

#2 globally

for green energy

investments

Source: Rystad Energy

Retrieved: June 3, 2024

Sustainable projects

made up 29% of total FDI

110% higher than the 5-year average

Source: fDi Markets, PitchBook

Retrieved: June 3, 2024

The future is green

“Canada is a leader in the green industrial revolution. Foreign direct investment in this space is propelling Canada’s clean energy capabilities and creating a surge in sustainable projects. Investments like these boost Canada’s energy-efficient practices, introduce innovative technologies, and contribute to building a strong economy for Canadians. As Canada moves to net zero to address the climate crisis, sustainable FDI isn’t just good for Canada, it’s good for the world.”

– Laurel Broten, CEO, Invest in Canada

Canada welcomes an unprecedented number of sustainable projects

A green year:

Sustainable projects

$26.7 billion invested

102% increase over 2022

35 projects

21% increase over 2022

9,500+ jobs created

Source: fDi Markets, PitchBook

Retrieved: June 3, 2024

Sustainable Projects as a % of Total FDI

In 2023, 29% of all inbound FDI to Canada was sustainable projects, marking a significant increase from 5-year and 10-year averages. Sustainable FDI in 2023 reached $26.7 billion, nearly triple the 5-year average of $9.7 billion.

Source: fDi Markets, PitchBook

Retrieved: June 3, 2024

Text version

| % of total FDI | |

|---|---|

| 2023 | 29% |

| 2022 | 25% |

| 2021 | 10% |

| 2020 | 5% |

| 2019 | 0.1% |

Source: fDi Markets, PitchBook

Retrieved: June 3, 2024

Strong growth continues

Total Net FDI Flows in Canada: 2014–2023

($ billions)

FDI into Canada continued to grow in 2023, outpacing the 10-year average by 13.9%.

Source: Statistics Canada Table 36-10-0473-01.

Retrieved June 3, 2024.

Text version

| Year | Total net FDI flows into Canada ($ billions) |

|---|---|

| 2014 | $65.2 |

| 2015 | $56.1 |

| 2016 | $47.8 |

| 2017 | $29.6 |

| 2018 | $48.8 |

| 2019 | $67.1 |

| 2020 | $34.3 |

| 2021 | $75.7 |

| 2022 | $60.1 |

| 2023 | $62.3 |

| 10-year average | $54.7 |

Source: Statistics Canada Table 36-10-0473-01.

Retrieved June 3, 2024.

Canada remains a top destination for investors

“In 2023, Canada continued to cement its position as a top destination for foreign investors. Canada’s biggest FDI flows were in reinvested earnings. This speaks volumes about Canada’s ability to attract and retain long-term global investors. Established companies are expanding their operations, adding new facilities and hiring more Canadians. Canada also saw growth in the manufacturing sector, up by nearly $6 billion over the 10-year average”

– Laurel Broten, CEO, Invest in Canada

FDI Flows by Type in 2023

(Reinvestments, mergers & acquisitions and other flows)

Global companies continued to actively reinvest in Canada in 2023, with reinvestments representing 44% of total FDI flows. Mergers and acquisitions (M&As) were the second strongest source of FDI flows by type of investment.

Source: Statistics Canada Table 36-10-0025-01.

Retrieved June 3, 2024.

Text version

| Type | Amount ($ billions) | % of total FDI |

|---|---|---|

| Reinvested earnings | $27.6 | 44.3% |

| M&As | $22.1 | 35.5% |

| Other flows | $12.6 | 20.2% |

Source: Statistics Canada Table 36-10-0025-01.

Retrieved June 3, 2024.

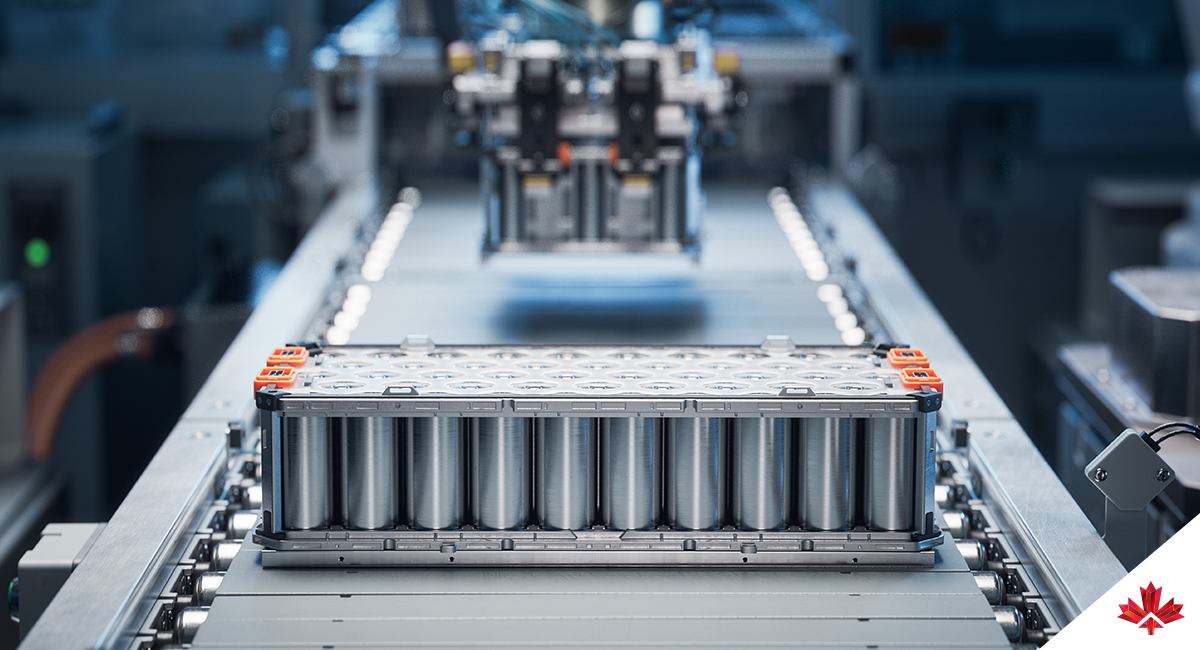

Strong growth in manufacturing driven by EV supply chain investments

FDI flows by industry in 2023 vs 10-year average

($ billions)

Canada saw strong growth across most industries in 2023. Investments in Canada’s electric vehicle supply chain account for the steep jump in manufacturing FDI flows, outpacing the 10-year average by nearly $6 billion.

Source: Statistics Canada, Table 36-10-0026-01.

Retrieved: June 3, 2024

Text version

| 2023 | 10-year average | |

|---|---|---|

| Manufacturing | $18.2 | $12.5 |

| Other industries | $16.1 | $12.2 |

| Trade and transportation | $8.7 | $8.1 |

| Energy and mining | $7.7 | $8.4 |

| Management of companies and enterprises | $6.1 | $8.1 |

| Finance and insurance | $5.5 | $5.5 |

Source: Statistics Canada, Table 36-10-0026-01.

Retrieved: June 3, 2024

The premier EV battery supply chain destination

“In 2023, some of the world’s largest automotive companies invested in Canada’s EV battery supply chain. Global leaders like GM, Ford, Northvolt and Stellantis recognize the immense opportunities at every step of Canada’s EV supply chain. They’re drawing on Canadian expertise and contributing to this thriving, sustainable industry.”

– Laurel Broten, CEO, Invest in Canada

Canada ranks

#1

on the global

EV battery supply chain

Source: BloombergNEF lithium-ion supply chain ranking

Driving a green future

Canada holds the Western Hemisphere’s longest history of mining all the critical minerals needed to build electric vehicles and EV batteries at scale. There are endless opportunities for foreign investors along the entirety of the EV value chain — from mining and mineral processing to battery recycling. Plus, Canada’s all-electric mining and leading-edge facilities are responsible for some of the world's most sustainably produced EV batteries.

Choosing Canada:

Investors from around the world

Top 5 investing countries in 2023

(by current stock)

Source: Statistics Canada, Table 36-10-0433-01

Retrieved: June 3, 2024

FDI growth spotlight

Germany, Japan and the United States show some of the highest increasing FDI flows. The percentages displayed show growth in FDI flows in 2023 as compared to 2018.

Source: Statistics Canada, Table 36-10-0473-01

Retrieved: June 3, 2024

High-value investments from diverse sources

“More and more countries are seeing Canada as the investment destination of choice. We’re attracting projects from leading companies in every corner of the world, including a steady increase from new investor countries. This diversity of source countries points to Canada’s strengths and underscores our immense value as an investment partner.”

– Laurel Broten, CEO, Invest in Canada

Investment into Canada by source country in 2023

($ billions)

This graphic represents FDI stock in Canada by country in 2023. The growth in FDI stock from 2022 to 2023 is indicated in percentages.

Source: Statistics Canada, Table 36-10-0433-01

Retrieved: June 3, 2024

FDI in action: 2023 investments

Working with our partners in communities across Canada, Invest in Canada attracts and facilitates global investments across strategic industries.

Notable investors who established or expanded operations in Canada in 2023 include:

BHP | Expansion of Jansen Potash mining project

Investment value: $6.4 billion

Estimated jobs: 900

Location: LeRoy, SK

Source country: Australia

Potash is an essential resource for food security and sustainable farming. Stage 2 of the Jansen Potash project will double production capacity and transform it into one of the world’s largest potash mines.

“This is an important milestone that underscores our confidence in potash and marks the next phase of the company’s growth in Canada. We believe Jansen will deliver long-term value for […] the local community.”

– Mike Henry, CEO, BHP

Dow | Net-zero petrochemical complex

Investment value: $8.9 billion

Estimated jobs: 7,000 temporary, 500 permanent

Location: Fort Saskatchewan, AB

Source country: United States

Alberta will make history as the home of Dow’s new Path2Zero world-leading facility. The complex is billed as the world’s first net-zero carbon emissions-integrated ethylene cracker and derivatives site.

“Dow chose Fort Saskatchewan because of the cost-competitive operations possible in western Canada and Alberta’s top-class workforce.”

– Jim Fitterling, Chair and CEO, Dow

E-One Moli | Battery R&D and manufacturing facility

Investment value: $1 billion

Estimated jobs: 350

Location: Maple Ridge, BC

Source country: Taiwan

E-One Moli chose British Columbia to expand its leading-edge lithium-ion battery cell R&D manufacturing plant. This milestone investment will support Canada’s position as a global leader in the sustainable production of critical minerals.

“E-One Moli […] looks forward to producing a pure green battery to support the world’s energy transition.”

– Nelson Chang, Chair, E-One Moli Energy (Canada)

Ericsson | Technology R&D centres

Investment value: $470 million

Estimated jobs: 300

Location: Ottawa, ON and Montréal, QC

Source country: Sweden

Ericsson’s investment in Canadian R&D centres will put the country at the forefront of global development in next-generation communications technologies.

“Ericsson’s R&D investment partnership with the Canadian government, supported by world-class talent in Ottawa and Montreal, will boost innovation and ultimately help to improve the lives of millions of people.”

– Börje Ekholm, President and CEO, Ericsson

Johnsonville Sausage | Pork processing plant expansion

Investment value: $52.8 million

Estimated jobs: 155

Location: Winkler, MB

Source country: United States

A joint venture between Winkler Meats and U.S.-based Johnsonville Sausage will see the diversion of live animals from export to the U.S., reducing truck transport and associated freight-related greenhouse gas emissions. The project will enhance the resilience and benefits of the supply chain and benefit the local economy.

“I’m still amazed today at how quickly we were able to get wastewater and water and the government on our side to make things move forward.”

– Michael Stayer Suprick, CEO, Johnsonville Holdings

Microsoft | Expansion of digital infrastructure

Investment value: $685 million

Location: Québec

Source country: United States

Microsoft is expanding its digital footprint in Canada with infrastructure for cloud computing and AI and cybersecurity skilling initiatives.

“These investments will […] enable a trusted and secure foundation to scale solutions faster to market and compete globally, securing Québec’s future in the digital economy. [This] is just the latest example of our deep commitment to this province.”

– Chris Barry, President, Microsoft Canada

Northvolt | EV battery hub

Investment value:$7 billion

Estimated jobs:3,000

Location:Saint-Basile-le-Grand and McMasterville, QC

Source country: Sweden

Northvolt chose Québec to establish its first EV battery plant in North America, drawing on Canada’s leadership in the EV technology sector.

“[Canada has] a completely decarbonized grid [that] is an instrumental tool to achieve the greenest battery in the world. Invest in Canada has been instrumental to guide us. It was really important to have a partner to dialogue with and try to steer the boat in the right direction.”

– Paolo Cerruti, Co-Founder, Northvolt and CEO, Northvolt North America

PowerCo | EV battery manufacturing

Investment value: $7 billion

Estimated jobs: 3,000

Location: St. Thomas, ON

Source country: Germany

A historic investment of $7 billion by Volkswagen Group-owned battery company Powerco will produce batteries for up to 1 million electric vehicles per year in Canada by 2027. This is North America's largest battery cell plant and the largest electric vehicle-related investment in Canadian history.

“We are honoured to partner with Canada, Ontario and the City of St. Thomas to take the EV industry to a new level.”

– Frank Blome, CEO, PowerCo SE

SK Ecoplant and WorldEnergy GH2 | Wind-to-green hydrogen project

Investment value: $67 million

Location: Newfoundland and Labrador

Source country: Korea

This green hydrogen investment, known as Project Nujio’qonik, confirms Newfoundland and Labrador’s place as a clean energy destination.

“Newfoundland and Labrador is positioned to launch this industry in Canada and to be amongst the very few first-mover commercial producers of scale world-wide. Project Nujio'qonik has world-class wind, abundant fresh water, a deep-sea port with close proximity to Europe, strong First Nations and community support, and support at all levels of government.”

– Kyung-il Park, CEO, SK Ecoplant

Bright future ahead for Canada

“The year 2023 was a remarkable one for us. Canada attracted the highest per capita foreign direct investment in the G7 and the third most total FDI in the world in the first three quarters of 2023. Attracting strong FDI partners is integral to driving growth, supporting productivity and boosting innovation in Canada. Invest in Canada will continue to showcase Canada’s strengths as we focus on growing industries that create a prosperous and sustainable future for Canadians.”

– Laurel Broten, CEO, Invest in Canada

Investors choose Canada with confidence

#2

in G7 & G20

for inbound FDI stock

as a % of GDP

Source: OECD

Retrieved: June 3, 2024

#2

in the world

for FDI confidence

Source: 2024 Kearney FDI Confidence Index

Retrieved: June 3, 2024

$1.4

trillion

total FDI stock

in Canada in 2023

Source: Statistics Canada, Table 36-10-0433-01

Retrieved: June 3, 2024

Our mission:

Find the best to invest

At Invest in Canada, we work in close partnership with industry, government and communities to attract foreign direct investment that yields positive, tangible results for Canada. Our team approach focuses on securing projects that advance Canada’s economic prosperity, support Canada’s commitment to sustainability, and offer Canadians a better quality of life.